Big cities in America have undergone seismic shifts in recent years, largely influenced by the shift to remote work that accelerated during the COVID-19 pandemic. As white-collar workers transitioned to remote and hybrid work models, many businesses found they were no longer tied to the physical office. Workers scattered beyond cities, triggering significant changes in the housing market.

The migration pattern was dubbed "the donut effect" by Stanford University economist Nicholas Bloom and Arjun Ramani, now a grad student at MIT. In a 2021 paper, they observed that the centers (or holes) of major cities in America saw big population decreases, while the surrounding areas of those places (the donuts) saw population gains. Urbanites, free from their daily commutes, sought more spacious and affordable housing outside of dense center centers, shifting supply and demand in the housing market.

To understand this transformation, Section 8 Housing analyzed academic research and Zillow data to see how the housing market in America has shifted since the pandemic.

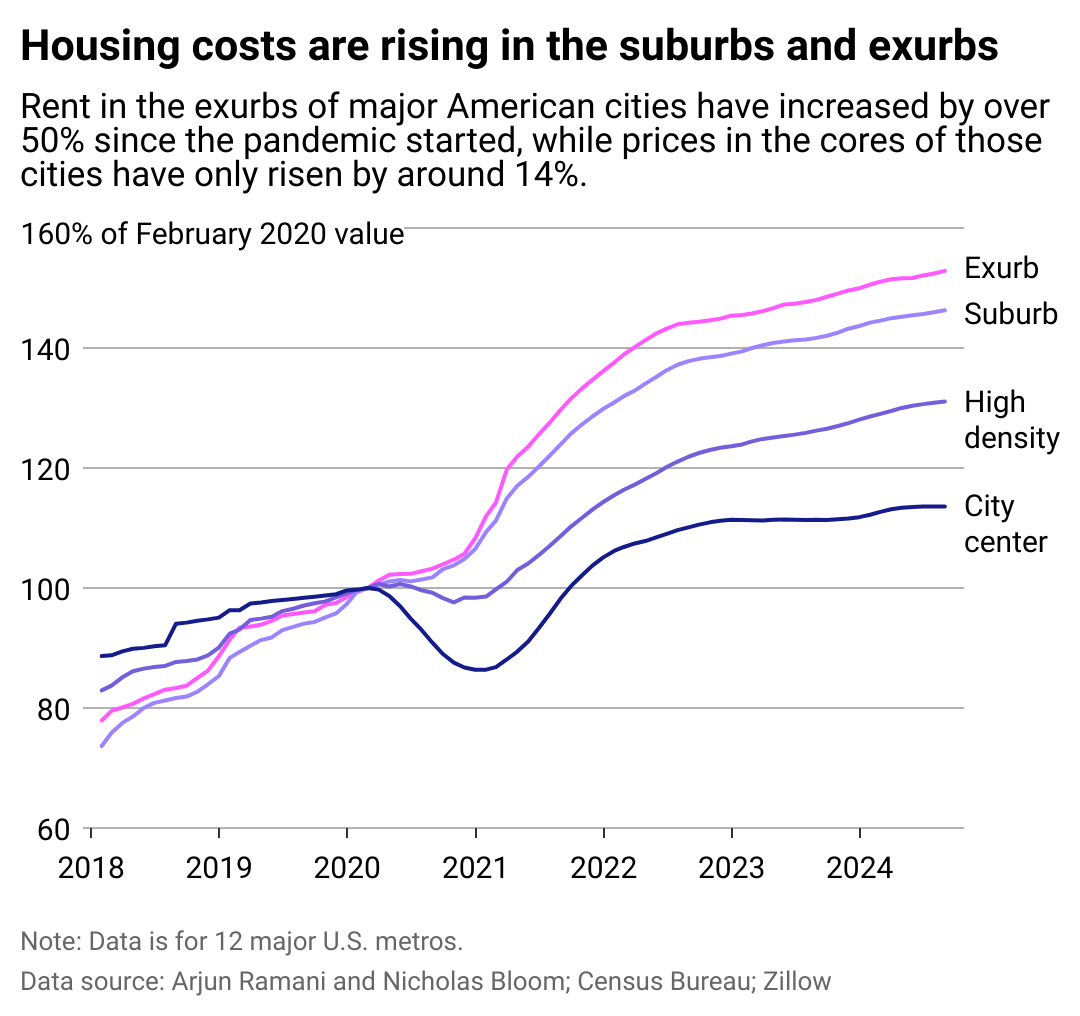

One way to see which geographic locations are growing in popularity is by tracking how much rental rates have changed. The Stanford study looked at 12 major metros in the United States, broken down by zip code. We have taken their analysis and updated it with figures projected through August 2024.

Our analysis reveals the trends the two researchers observed in 2021 have largely persisted. Between February 2020 and August 2024, rent in the centers of 12 major metros in the U.S. has risen by around 14%. Rents increased by around 31% in high-density areas in these regions. Meanwhile, rents have increased by around 46% in the suburbs of these major metros, and 53% in the exurbs.

Recent housing trends show more people are moving within metros, as opposed to between metros, according to the Stanford analysis. Hybrid roles, which allow people to go into the office a few days of the work week, have allowed for longer commutes but not major moves out of the region entirely. In other words, while some "Zoom towns" have boomed, the number of people moving from big cities to more remote locales is limited compared to the number who have moved to the suburbs. Consider that two of America's top 10 Zoom towns in 2023, Naperville and Arlington Heights in Illinois, are both in the suburbs of Chicago.

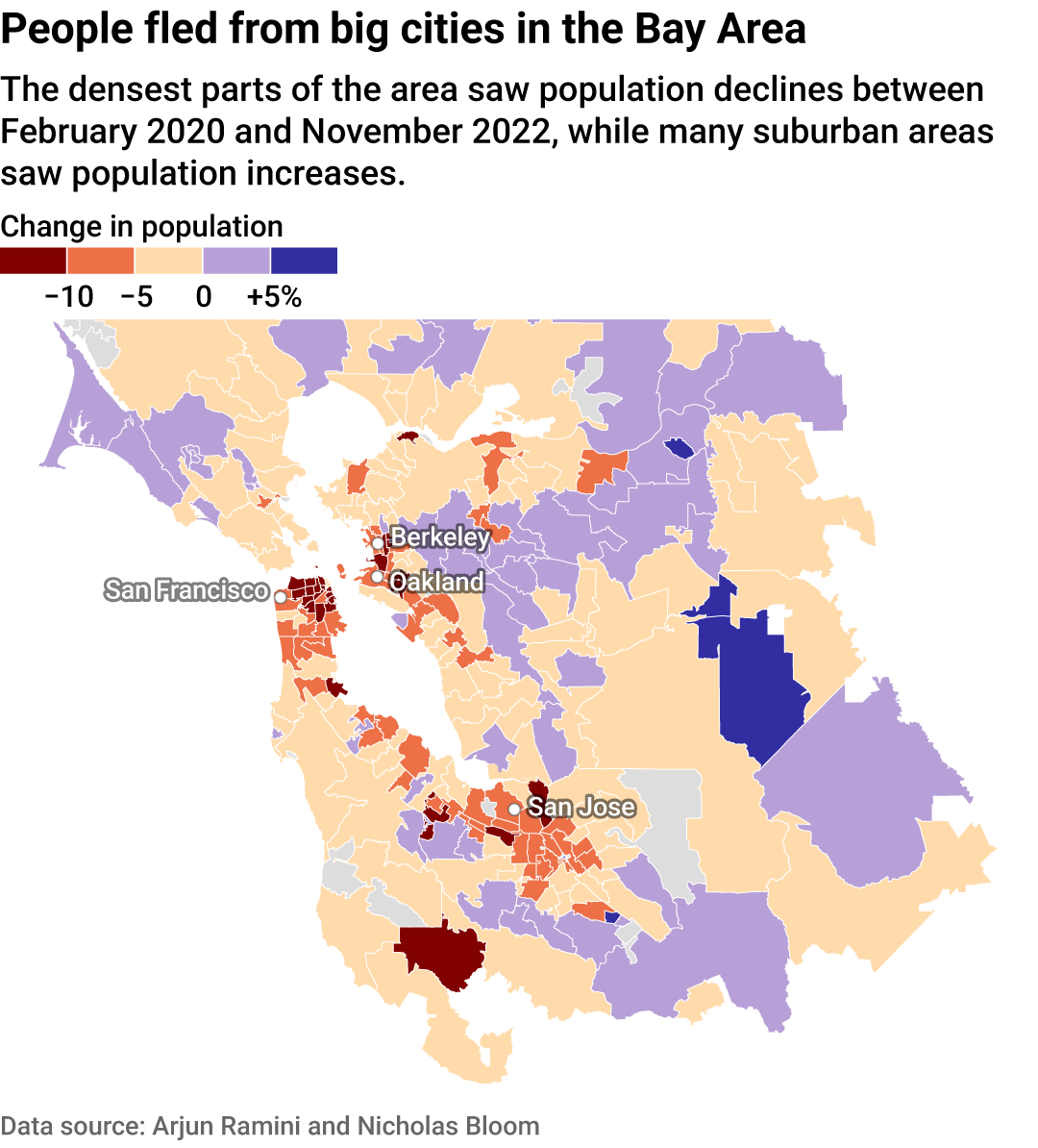

The San Francisco Bay Area, known for its tech-driven economy and sky-high cost of living, starkly illustrates the donut effect. Bay-area hotspots like San Francisco, Oakland, and San Jose have seen severe population declines, as remote work and rising living costs have pushed many residents to suburban or exurban areas, particularly in the hills east of Oakland.

Between February 2020 and November 2022, several of San Francisco's densest neighborhoods saw population declines of over 20%, according to change-of-address data from the U.S. Postal Service. While rising housing costs played a major role in this exodus, other factors also contributed. Increasing concerns about public safety and rampant public drug misuse have driven some residents and businesses away, sparking fears that the city could fall into a doom loop, in which it will not be able to recover its economic and social status.

Four zip codes in the city of San Francisco saw population declines during this period of over 20%, including parts of Pacific Heights, SoMa, Mission Bay, and more—all relatively high-density areas. In contrast, two of the zip codes that saw some of the biggest percentage increases in population were Alamo and Bethel Island, two smaller communities that are about 30 and 60 miles east of San Francisco, respectively.

The City by the Bay has started to rebound, albeit slowly. The latest Census data shows that between 2022 to 2023, San Francisco's population grew by around 500 people to nearly 809,000. That is still well below its 2020 population of 873,965 people. Official data show that property crime was down nearly a third in the first quarter of the year. Meanwhile, the fact the city is ground zero for the artificial intelligence boom bodes well for its job market.

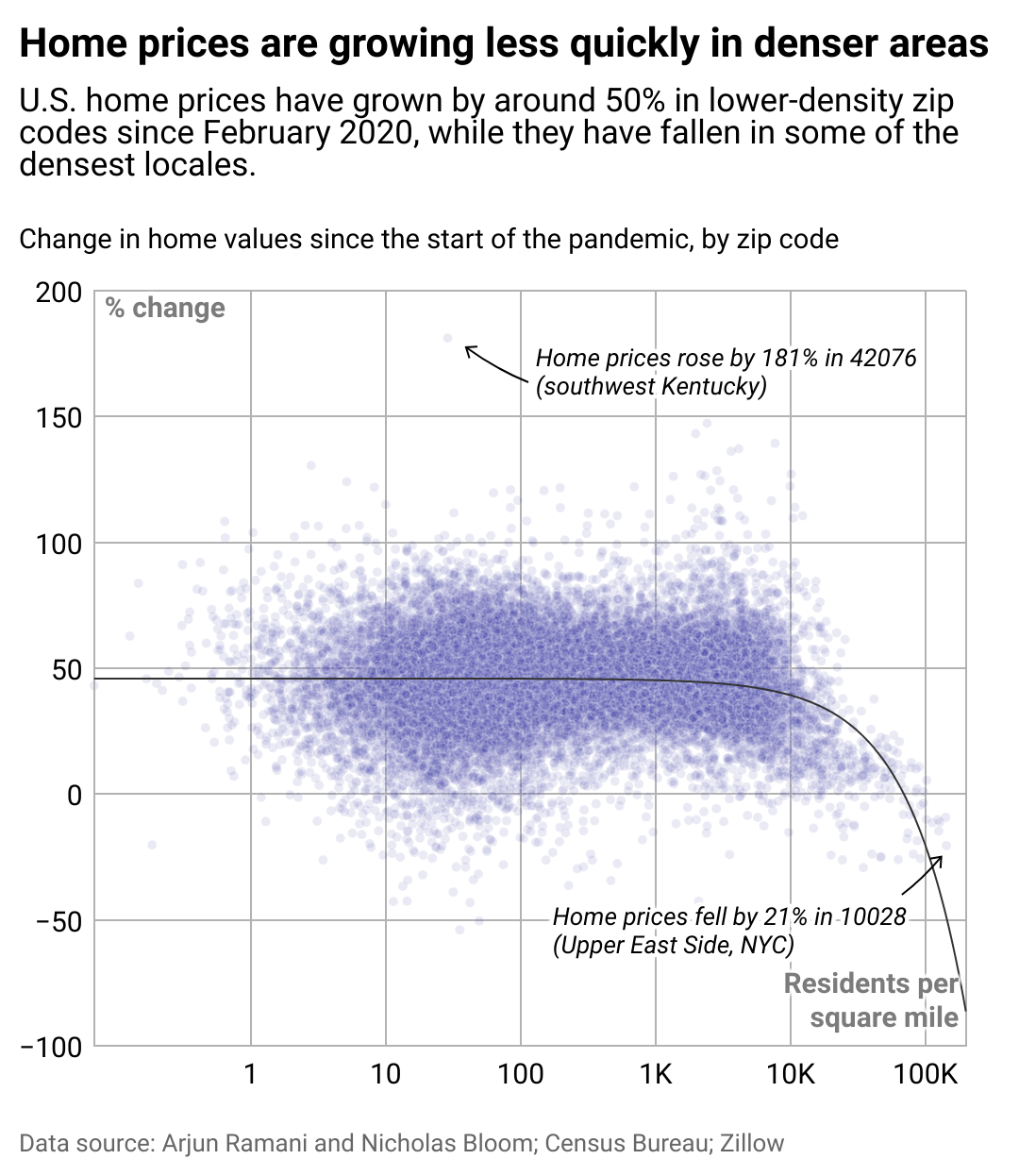

Like rent, home prices have gone up more quickly in rural and suburban locales. Home prices across most of the United States have increased by an average of around 50% since February 2020. Home prices have risen much more slowly in denser parts of the country. The densest zip code in America, 10028, corresponds to part of the Upper East Side in New York City. Home prices there have fallen by around 21%.

These trends represent a twist on the patterns seen over the past few decades. Starting in the 1980s, "superstar cities" emerged in the United States, pulling away from the rest of the country economically. Cities like New York, San Francisco, and Los Angeles became hotbeds for jobs for white-collar workers, attracting college graduates seeking work. This trend continued throughout the 2010s all the way up to the pandemic; housing costs in these major metropolitan areas skyrocketed accordingly.

In addition to housing costs, the post-pandemic shift toward the suburbs and an increase in remote work have drastically impacted local economies. Office vacancies hit a record 20.1% in the second quarter of 2024, according to Moody's. This has caused trouble not just for real estate companies, but city governments as well. Many big city governments are facing budget shortfalls. If current real estate trends do not reverse themselves soon, city governments might have to cut their budgets, or raise taxes to make up the deficits.

These changes to the housing market might not last forever. Many big companies like Disney and JP Morgan have already started to issue return to office notices for their workers. On Sept. 16, Amazon CEO Andy Jassy announced the tech giant would require its workers to be present in the office five days a week, arguing that it would better foster collaboration amongst its employees.

Not all workers are pleased by the prospect of returning to their pre-pandemic commuting patterns. According to a survey conducted by KPMG in July and August, 83% of big company CEOs say they expect a "full return to office" over the next three years, up from just 64% in 2023. How America's cities will fare in the future may hinge on how the debate between corporate mandates and workers' desire for flexibility ultimately shakes out.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Kristen Wegrzyn.

This story originally appeared on Section 8 Housing and was produced and distributed in partnership with Stacker Studio.